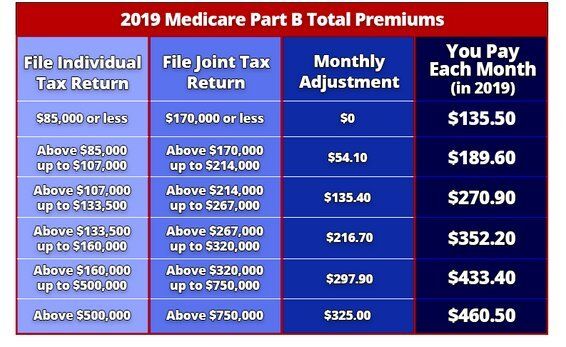

IRMAA stands for Income Related Monthly Adjustment Amount and is applied to higher income earners who’s AGI is over $85,000, or over (for a single person or married couples filing separately), and $170,000 for married couples who file taxes jointly. If you or your family meet these guidelines your Medicare Part B and Part D will be adjusted accordingly on a sliding scale. One thing to consider is that you have the right to request a reduction of IRMAA if you no longer meet the income limits outlined by Medicare. F

or instance, if your 2017 AGI was over $85,000 as a single person or $170,000 as a married

couple and now you’re retired and no longer bringing in this level of income, you can bring proof of your current income to the Social Security office and they will adjust your Part B and Part D accordingly. Many people do not take advantage of this and end up over-paying for their Medicare. If you are interested in more details about IRMAA and how it may affect you, please contact our office at 408-398-1929 and we will send you the electronic PDF titled, "Medicare Premiums: Rules For Higher-Income Beneficiaries".